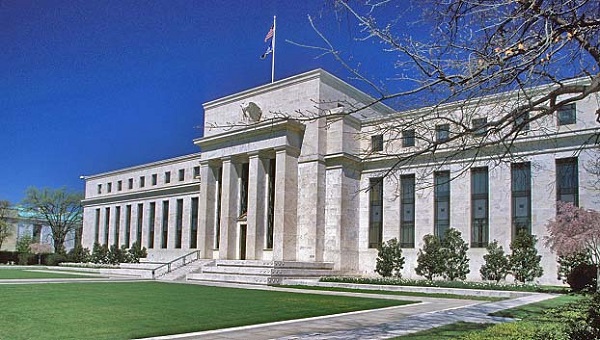

The US dollar has remained flat following comments from a number of Federal Reserve policymakers signaling moderate interest rate rises on the horizon, with investors looking ahead to next week’s US inflation data.

New York Fed President John Williams said that moving to a rate between 5.00% and 5.25% “seems a very reasonable view of what we’ll need to do this year”.

Williams’s remarks followed Chair Jerome Powell’s use of the term “disinflation” when speaking on upcoming policy decisions.

The dollar index, which compares the U.S. dollar to six other currencies, rose 0.029% to 103.460 on Thursday, after falling nearly 0.3% in the previous session.

The index is close to the one-month high of 103.96 that it reached on Tuesday during a brief rise following Friday’s employment report, which revealed that non-farm payrolls increased by 517,000 in January.

The data raised hopes that the Federal Reserve may return to an aggressive monetary policy stance, although Powell did not elaborate on this point in his Tuesday statement.

Market forecasts have the Fed funds rate peaking just above 5.1% in July before declining to 4.8% by the end of the year.