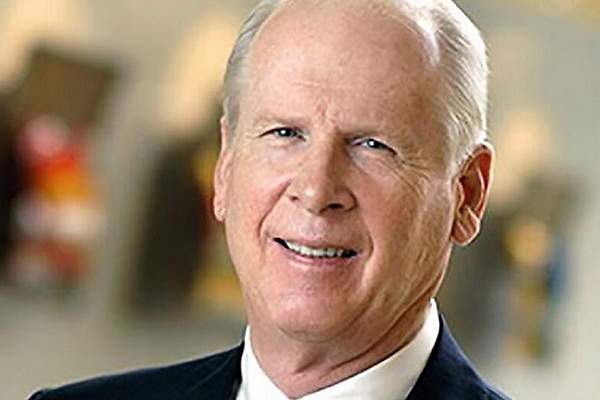

A federal grand jury in San Francisco, California, has returned a 39 count indictment against Texas tech mogul Robert T. Brockman in a $2 billion tax evasion case, the largest ever case of its type in U.S. history.

The indictment alleges that Brockman, CEO of software company Reynolds & Reynolds, engaged in tax evasion, wire fraud, money laundering and other offenses over the course of a 20-year period, concealing approximately $2 billion in income from the Internal Revenue Service.

The 79-year-old made an initial appearance in federal court on Friday, where he entered a not guilty plea to all counts and was released on a $1 million bond.

Brockman first achieved success in the 1970s with Universal Computer Systems, the software company he founded. UCS merged with Reynolds & Reynolds in 2006, and Brockman is currently CEO and chairman.

Reynolds & Reynolds were naturally keen to distance themselves from the controversy, stressing that the charges against Mr. Brockman relate to alleged actions carried out in a personal capacity.

“The allegations made by the Department of Justice focus on activities Robert Brockman engaged in outside of his professional responsibilities with Reynolds & Reynolds,” said a company spokesperson. “The Company is not alleged to have engaged in any wrongdoing, and we are confident in the integrity and strength of our business.”

Should Brockman be convicted the sums involved would eclipse the current record. In 2007 Walter Anderson was sentenced to nine years in prison after evading an estimated $200 million in tax.

“The allegation of a $2 billion tax fraud is the largest ever tax charge against an individual in the United States” said David L. Anderson, the U.S. attorney for the Northern District of California, speaking at a news conference.