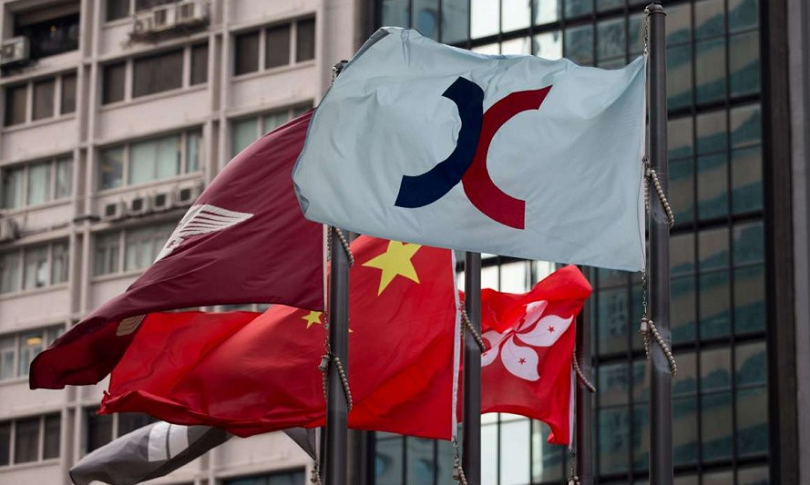

July 6, 2018 – Hong Kong shares set course for a fourth consecutive day lower today, with investor caution prevailing as Washington’s import tariffs on Chinese goods became effective.

The Hang Seng Index had slipped 0.5% to 28,046.89 by the noon break after rising as high as 28,326.27 earlier in the morning. Industrial & Commercial Bank of China and Bank of China shed 0.9% and 1.1%, respectively.

Among other heavyweights, insurer AIA Group declined 1% while London-headquartered lender HSBC Holdings lost 0.7% and Tencent Holdings, the most valuable company listed in Hong Kong, shed 0.6%. In mainland China, the Shanghai Composite Index dropped 0.3%.

The U.S. brought into effect import tariffs on $34 billion of Chinese goods at noon today Hong Kong time. China’s Ministry of Commerce criticized the move as the initiation of the largest trade war in economic history and vowed to retaliate, adding that Beijing plans to safeguard its country’s core interests.

“We need to see if this will bring about another round of shockwaves, but I personally believe the Hang Seng Index and the Shanghai Composite can get fundamental support at present levels,” said Stanley Chik, head of research at Bright Smart Securities in Hong Kong, adding that “Hong Kong equities cannot perform well unless the A-share market recovers.”

Investors are nervous about a further escalation in the trade spat between the two nations as U.S. President Donald Trump has also threatened to impose additional levies on a further $200 billion of Chinese imports.

Property developer Sunac China Holdings edged 0.2% higher in Hong Kong after reporting a 61% jump in contracted sales for June to 45.96 billion yuan ($6.91 billion).

ZTE climbed 3% after it appointed Xu Ziyang as president of the company, while Li Ying was named chief financial officer and one of three executive vice presidents. The changes came after U.S. authorities imposed a $1.4 billion fine on ZTE and asked for sweeping changes to its board and management to lift a ban on American companies from selling parts to the Chinese telecommunications-equipment maker.

Guangzhou Automobile Group fell 2.6%. The carmaker last night reported a 4.6% increase in June sales to 178,962 units.